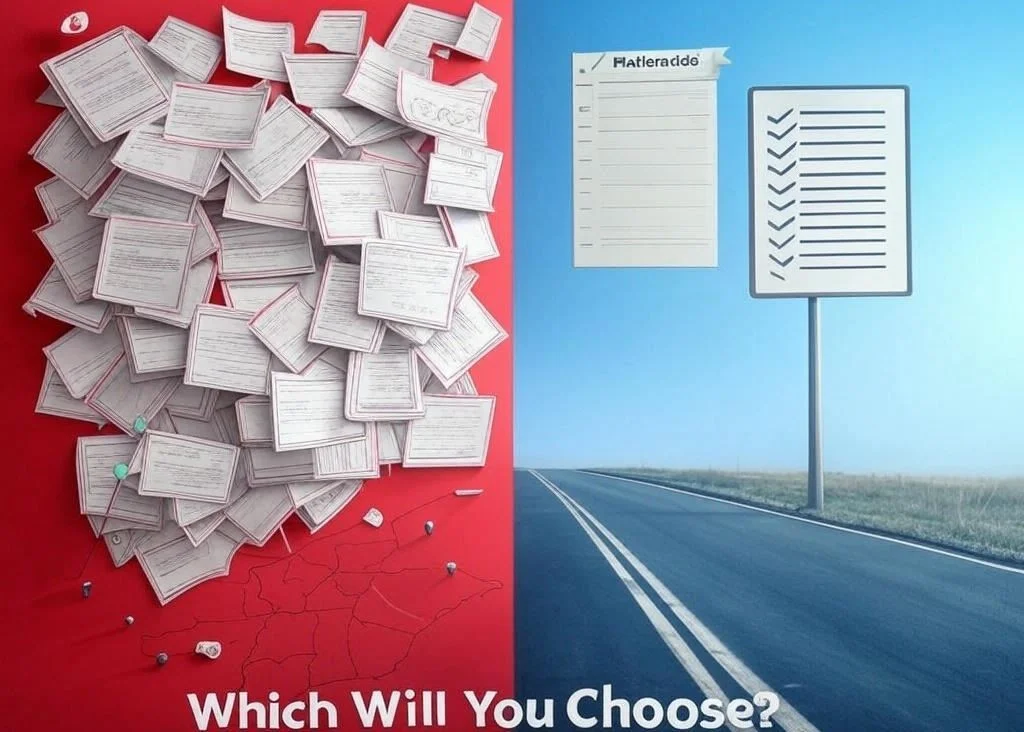

Choosing between state and federal mortgage licensing is a critical decision for lenders. State licensing comes with costly compliance and slow approvals, while federal licensing enables nationwide expansion with no upfront costs. Discover which model is right for your mortgage business!

Mortgage rates have dropped to their lowest levels since December, making homeownership more affordable. Learn what this means for buyers and sellers in today’s market.

Why gamble with unlicensed loan officers when one wrong move could bring everything crashing down? With Peoples Bank’s P&L platform, compliance is built-in—allowing you to operate in all 50 states without individual licensing hassles. No legal risks, no state-by-state roadblocks—just seamless growth on a rock-solid foundation. Operating without proper licensing can lead to fines, lawsuits, and even criminal charges—just ask companies like LoanSnap, 1st Alliance Lending, and RPM Mortgage, which faced costly penalties for non-compliance. With Peoples Bank, you eliminate these risks entirely. Our national charter keeps you compliant, secure, and ready to scale without limits.

Learn how capital gains taxes work when selling your home and how to reduce what you owe. Consult a tax professional for personalized advice.

Mortgage demand is surging as rates drop. Don’t wait—now’s the time to apply and lock in your opportunity before competition heats up.

Mortgage rates have dropped to a 4-month low, creating new opportunities for homebuyers and homeowners looking to refinance. Learn how to take advantage of lower rates today.

In 2025, buying a home is more affordable than renting in most U.S. markets. Learn why homeownership remains the smarter long-term investment.

Home prices are rising at a steady pace, creating great opportunities for buyers and sellers in 2025. Learn how this balanced market benefits you!

Thinking about moving in 2025? Learn why so many Americans are relocating and how to turn your dream move into reality with the right planning