The Trump administration says it’s exploring 50-year mortgage options to help with affordability. Learn what this could mean for homebuyers, monthly payments, and long-term costs.

Fannie Mae’s new credit score policy lets lenders use automated approvals even for borrowers below 620. Here’s what that means for homebuyers who thought they couldn’t qualify.

Mortgage rates dipped, then jumped after the Fed’s cut. A $15B corporate bond sale and stronger economic reports added pressure. Here’s the simple, kid-level way to understand what’s happening and what it means for buyers.

The Federal Reserve cut rates again, but mortgage rates actually rose. Learn why this happens, what Powell said, and what it means for homebuyers.

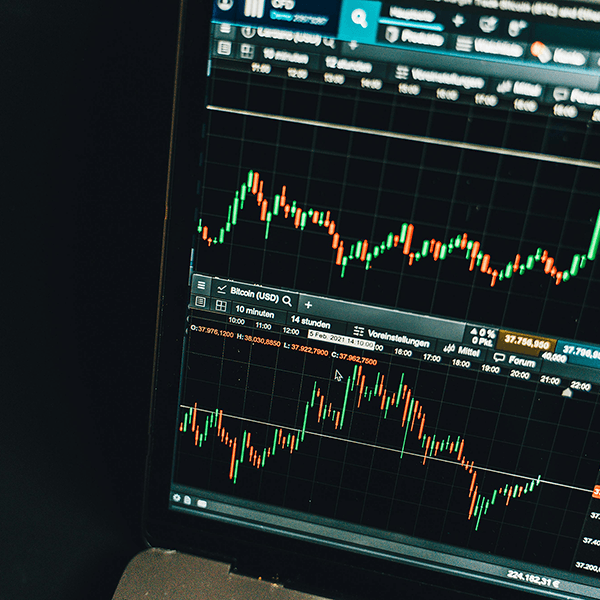

The average 30-year fixed mortgage rate is hovering near 3-year lows as bond markets hold steady amid limited economic data. Learn why rates remain low and what could move them next.

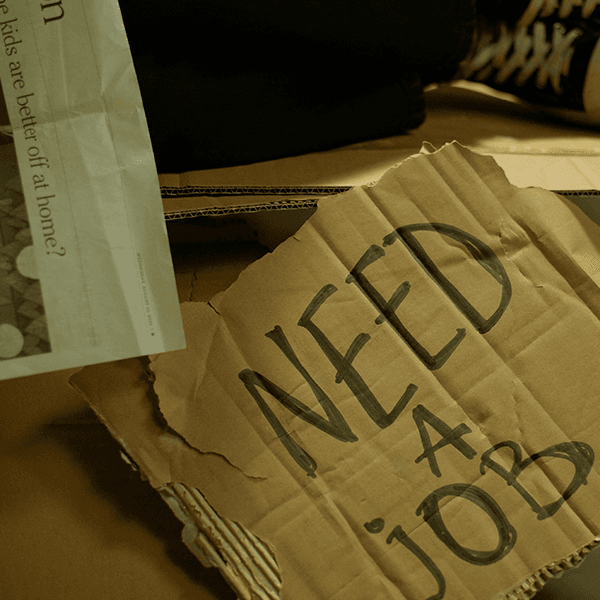

A new Realtor.com survey reveals that 1 in 5 Gen Z adults say housing affordability is their top life concern. Learn how young buyers are adapting, saving, and staying determined to achieve homeownership.

On October 9, 2025, the average 30-year fixed mortgage rate edged slightly higher to 6.38% after a weaker 30-year Treasury auction and mild MBS underperformance. Rates remain stable within a narrow range as the government shutdown continues.

On October 1, 2025, the average 30-year fixed mortgage rate held at 6.37% after weak private payroll data. Bigger shifts may follow when the delayed government jobs report is released.

Affordability is finally improving this fall thanks to lower average 30-year fixed mortgage rates, slower home price growth, and rising wages. Learn why now could be the right time to buy.